“If women want to change the status quo, they should invest in the tech that does that.”

Continue readingSports v Esports: What The League Of Legends Finals Tell Us

Just a few short years ago, there was a lot of excitement in sports about the emerging ‘thing’ that was esports.

Continue readingKeep Your Eye on Blockchain

Last week Stripe, the payment platform, agreed to buy Bridge Network for the rather unicorn-sized sum of $1.1 billion. This figure would eye-watering enough – but it is also based on a 200% increase in valuation since August.

Continue readingAI In Sports Is A Bit ‘Last Christmas’

The funniest WhatsApp I saw last week was when one wit stated: ‘These days, avoiding AI at a sports conference is like playing Whamageddon at Christmas.’

Continue readingTop Tips for Crafting a Standout Sports Technology Awards Submission

Each year, there are a few common questions about how to make submissions in The Sports Technology Awards truly shine. To help, here are our top tips to ensure your work stands out and catches the judges’ attention:

1. Nail the Category Criteria

It sounds obvious, but fully understanding what each category asks for will help you write sharper, more relevant answers. This not only impresses the judges but also ensures you’re entering the category best suited to your work.

The entry form is clear, but if you’re unsure, reach out to us—we’re here to help maximize your chances of success.

2. Keep Your Language Clear and Focused

We see two common pitfalls that are easy to avoid…

- International entries sometimes lose meaning in translation so be sure your entry says what you really need it to

- Avoid use of superlatives like “tremendous” or “astonishing” the judges want facts. if your work is great, the judges will appreciate it.

With a limited word count, stick to the facts. A clear, concise form is always more compelling. It is always a good idea to have someone proofread to ensure your submission reads well.

3. Start Early to Finish Strong

Completing your entry doesn’t take long once you have all the information ready. Block off 30 minutes to familiarize yourself with the form and gather what you need—logos, team inputs, payment details, etc. Give yourself time to chase down any missing pieces and then set aside 90 minutes to complete your entry. This ensures a smooth process and avoids last-minute fees and pfaff.

4. Customize Each Entry for Multiple Categories

If you’re entering multiple categories, take the time to tailor each submission. Judges may see your work in several categories, and they’ll notice if you’ve simply copied and pasted and it might undermine what you’re saying. A tailored entry for each category will resonate more and increase your chances of success.

5. Hard Data Makes for Stronger Entries

Our judges sign NDAs, so feel confident sharing detailed information. Where possible, use solid numbers over vague percentages or general endorsements. Strong facts make for a more compelling case!

6. Being Shortlisted is a Major Achievement

Don’t miss the opportunity to celebrate if you make the shortlist—it’s no small feat! The competition is tough, and the difference between winning and placing second can be the matter of a point or two! A spot on the shortlist is a significant success well worth promoting.

Our judges are passionate about recognizing excellence, so if you have any questions about your entry, let us know! We believe that stronger entries lift the competition as a whole—good luck!

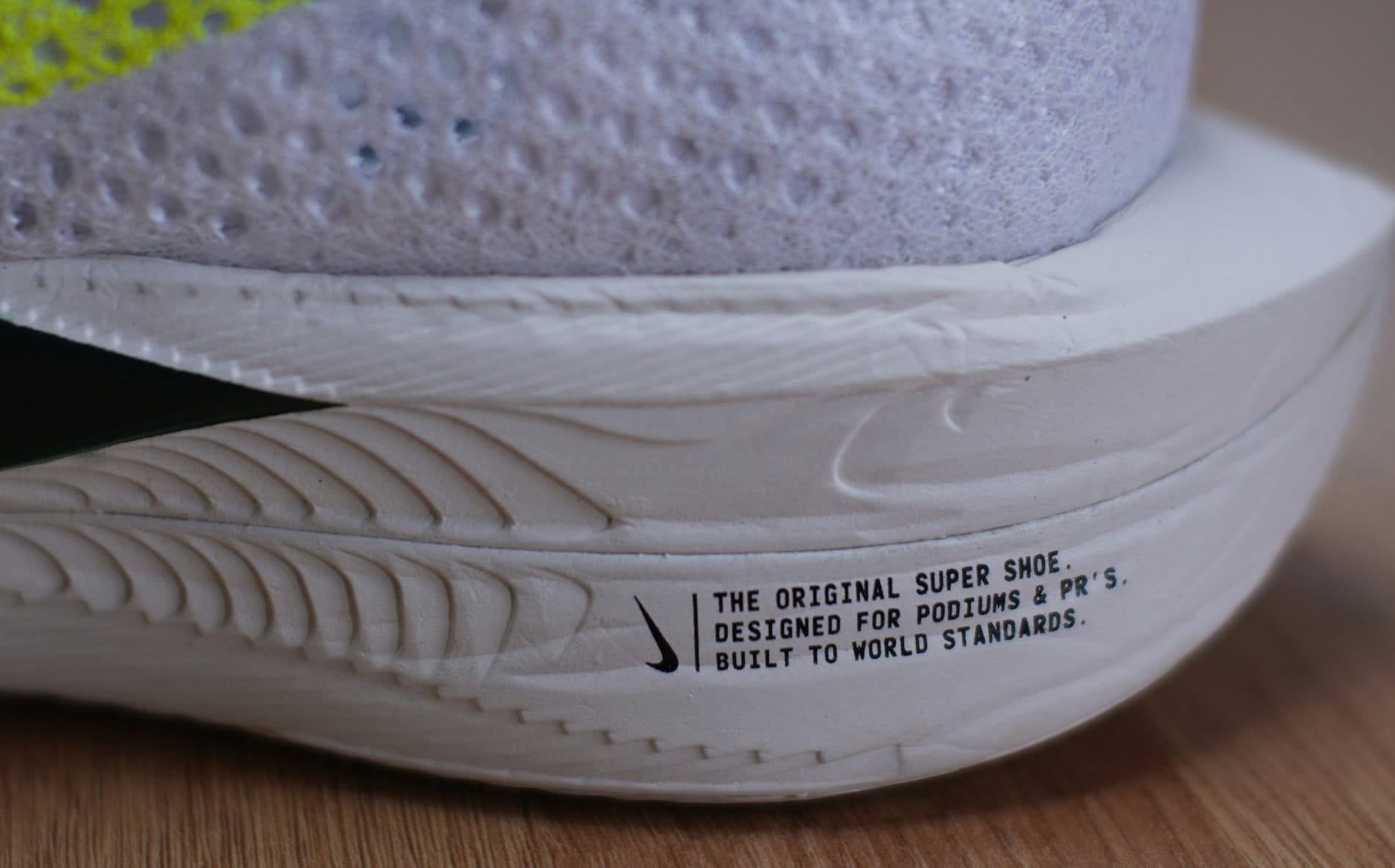

Are Tech-Enabled World Records the Wrong Sort of Dopamine?

When Ruth Chepngetich won the Chicago Marathon last Sunday, she did so in a staggering, record- breaking time of 2.09.56.

Continue readingTo NFT or Not to NFT – Is it Still a Question?

So, has Paris 2024 jumped on a bandwagon that looked like it had already departed?

Continue readingBoards, Not Boring

Has anyone ever started an article with the words, ‘poor Nike’?

Well, today I do.

Is Sports’ Tone of Voice Hitting the Wrong Chord On Injuries?

We’ve all heard and seen stories of young professional sportspeople defying good sense to go for glory. There was even an extensive montage paying tribute to ‘injury highlights’ in the opening ceremony of the Paris Olympics. But has the time come to change our tone of voice when discussing athletes and injuries?

On Saturday night, a super-charged, super-hyped boxing match saw Anthony Joshua badly beaten; AJ took four massive blows to the head before being finished in the fifth. Two weeks ago, the Miami Dolphins’ star quarterback, Tua Tagovailoa, suffered a third major concussion. Despite the suggestion he rethinks carrying on in the NFL – including from players – Tagovailoa is going to serve a month out before attempting to take to the field again.

It’s understandable: for these men as for many athletes, the money is mind-blowing. They have financial responsibilities; they are young and probably feel invincible.

Sportspeople are, overall, a tough lot, many of whom have been brought up with The Black Knight ethos of ‘it’s just a flesh wound’ despite being down two arms. They want to show the crowd – and themselves – they are fine, hence they determinedly limp off the pitch with an ACL, compete when injured and – worst of all at amateur or junior level – cave in to peer or coaching pressure to return quickly. All too often, the background commentary to this are words like ‘bravery’, ‘resilience’, ‘grit’ and ‘legend’.

Undeniably sportspeople have all of these qualities, but to use them alongside injuries like brain trauma and serious injury takes us all to a very dangerous place – not least the person to whom they are being ascribed.

But it’s not just the language that needs to change. It’s time to shift the sports science and tech conversation too.

It’s become a widely accepted issue that the majority of sports and health science research has male bias. Yet it is one thing stating that, another addressing it, and yet another to determine which area of the body to prioritize.

Much has been made of ACL injuries in women but what about mitigating female head injuries? Men are known to sustain brain damage through heading a soccer ball, yet nothing has been done to mitigate the risk to women – despite our necks being 32% weaker in flexion and 20% weaker in extension. Women don’t want to play with a lighter ball than male counterparts but, as the women’s game’s rises, sensible measures are needed quickly.

There is a growing pool of scientific research and medical tech that is helping governing bodies make better-informed decisions, but that comes with a Catch-22. For those in charge to use the tech, it needs to be scalable, affordable and standardized (ie, it lets someone tick a box). For tech to get to that point, it needs those in charge to use it. You can see the issue.

Sports’ bosses have a tricky balancing act. There is an ethical imperative to safeguard those who play sport, a financial imperative to safeguard their code’s longevity, and an aesthetic imperative to ensure that fans aren’t uncomfortable with the spectacle presented to them – not least as those fans have the power to prevent the next generation participating. In this landscape, managing serious issues like head trauma is hard but is essential. Unfortunately, there’s no immediate consequence for those who choose to kick this can down the road.

So what can be done to prevent young athletes mortgage their future health for our entertainment? Firstly, as suggested by the team at Love of the Game, it is time to introduce head scans for elite athletes when they reach 23. This is when the brain stops developing and will provide medics with a baseline by which to measure any future traumas. We also need to make athletes aware of what options are there for them – you’ll frequently see a footballer with their own GameReady kit, but I only know of one retired athlete with a PolarCap.

The conversation around Tagovailoa injury, when it happened, was very considered, but with each head trauma headline the subject risks becoming less newsworthy. We all want to recognize and celebrate the effort it takes for an athlete to return from injury, but glorification of poor choices is not good for sport. It certainly is very, very not good for sportspeople.

As for the Olympic montage? I once asked Derek Redmond what he felt about seeing the clip of his heartbreaking hamstring tear in Barcelona used so often.

His response: “I’d rather be remembered for what I won.”

Please read Love of the Game’s excellent chapter on Concussion and the role technology is playing in it, in The 2023 Sports Technology Annual Review available here

The Geek Will Inherit the Earth

Adrian Newey is something of a big deal in Formula One design.

Continue reading